Soaring container shipping prices are expected to reach their limits during the summer. But everything suggests that freight rates will stabilize at high levels.

UPDATE 9/24/2021

WORLDWIDE

Demand is still way higher than supply; capacities remain tight; upcoming events such as the Golden week, Halloween, Thanksgiving, or Christmas increase even more the level of transportation demand while prices are skyrocketing.

The current market conditions are anything but normal. Capacity is scarce and moving freight is more expansive and challenging than it has ever been. Adding another layer of complexity to already stressed supply chains, some steamship lines, and freight forwarders are putting restrictions on how far inland they'll move containers.

This long-term rising shipping cost crisis will likely hit cargo shippers ranging from food and beverage companies to retailers and automakers. Across the world, supply chains will have to cope with late deliveries and higher logistics costs as they strive to meet high customer demand or replenish inventory levels ahead of the year-end holidays.

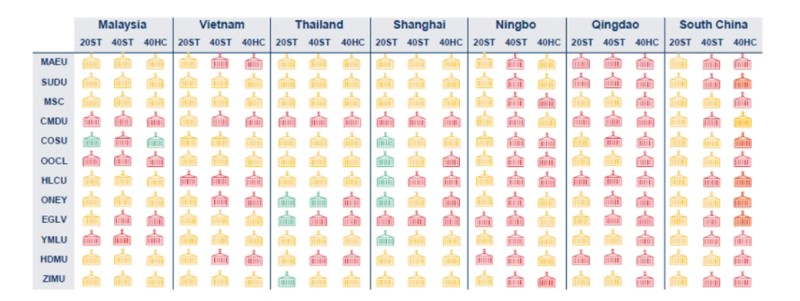

Asia equipment availability as of Sept 16th, 2021.

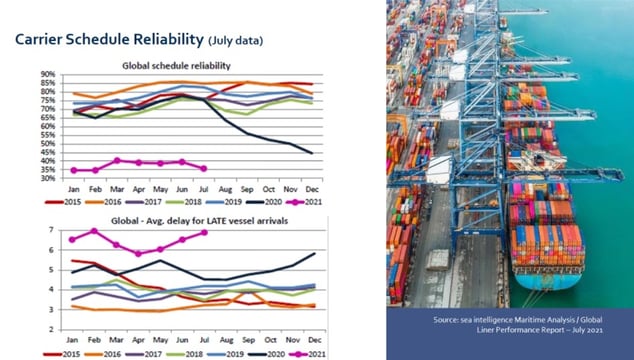

Only an average of 35% of WW containerships is on schedule, which, in the transportation market, is close to 0.

Most important ports in Asia, the USA, and Europe are congested; which leads to longer lead times in deliveries, but more importantly, reduced capacities out of Asia (when containers wait for delivery in Europe or the USA, they are not available for export out of Asia)

SITUATION IN THE USA

There are currently 65 ships (+31) at anchor awaiting berths in Los Angeles/Long Beach as of Friday, Sept 17th. Ships are waiting an average of 9-11 days to catch a berth. Both ports are seeing record volumes month after month. Volumes are up 30% so far this calendar year. Delays forcing ships to wait at anchor are expected to continue for the remainder of the year, at least. Imports wait for an average of 6 days for a truck to pick up, and street dwells are up to 9 days on average. Import rail dwell is up to 12 days in the terminal complex.

All terminals remain extremely congested and evaluating a reduction on their window for export cargo acceptance from four to three days. Traffic jams are nothing new for Southern California. But what’s happening at the ports of Los Angeles and Long Beach is truly historic. Record demand for imported goods, beginning in mid-2020, coupled with shortages of truckers, shipping containers, and other equipment, has slowed ship unloading and left dozens of vessels waiting offshore.

The overall situation in US ports:

• Chicago (USCHI) –Constrained on 40’ chassis.

• Louisville (USLUI) – Deficit on 40’ chassis.

• Indianapolis (USIND) – Deficit on 20’ and 40’ chassis.

• Houston (USHOU) – Deficit on 40’ chassis.

• Detroit (USDET) – Deficit on 40’ chassis.

• Memphis (USMEM) – Deficit on 40’ chassis.

• Tampa (USTPA) – Deficit on 40’ chassis.

• New York (USNYC) – Deficit on 40’ chassis.

• Seattle (USSEA) – Constrained on 20’ and deficit on 40’ chassis.

• Tacoma (USTIW) – Deficit on 40’ chassis.

• Los Angeles / Long Beach (USLAX/USLGB) – Deficit on 20’ and 40’ chassis.

UPDATE 9/13/2021

WORLDWIDE

Current market conditions are anything but normal. Capacity is scarce and moving freight is more expansive and challenging than it has ever been. Adding another layer of complexity to already stressed supply chains, some steamship lines, and freight forwarders are putting restrictions on how far inland they'll move containers.

CHINA

Category 1 Typhoon Chanthu will bring max wind gusts up to 86 mph, impacting China, Korea, and Japan. The storm’s primary threat is flooding in and around Shanghai with up to 10-15 inches of rain, possibly causing port closures for multiple days and restricted vessel movements. Chanthu will likely impact the world's most concentrated supply chain area at the Port of Ningbo, in addition to the Shanghai Pudong Airport.

FRANCE

Main harbors and ports will be on strike in France starting tomorrow Sept 15th for 24 hours; this will impact lead times and transit times, and therefore there will be additional delays in the supply chain

SITUATION IN THE USA

Container lines are increasing capacity on the Asia-US trades by double-digit percentages, but port congestion in Asia and the US is blunting the actual capacity available to shippers — keeping upward pressure on rates.

However, the double-digit increase in capacity is likely to further stress ports that are already contending with vessel bunching in the early days of the peak shipping season.

For example, there are 50 vessels at anchorage in Los Angeles-Long Beach awaiting space, while terminals each day are working about 30 container ships at berth, with more vessels scheduled to arrive daily.

The ports of Los Angeles and Long Beach provide an egregious example of vessel bunching, but other ports, including Oakland, the Northwest Seaport Alliance of Seattle and Tacoma, Savannah, and New York-New Jersey have contended with vessel bunching on and off over the past few months.

On paper, carriers deployed sufficient capacity to handle the containerized imports from Asia, but glitches throughout the international supply chain reduced the effective capacity of the vessels being deployed.

Vessels were delayed leaving some Asian load ports, including Yantian and Ningbo, because of terminal closures related to COVID-19 outbreaks.

Once they reached US ports, vessel delays have ranged from several days to more than a week as the ships idled at anchor awaiting berthing space.

UPDATE 9/6/2021

- The price of a 40 ’container is between 7 and 10 times more expensive from Asia to Europe than back in 2019.

- The transit time from Asia to the American coasts has more than doubled.

- There are twice as many container ships waiting in the world.

- From Asia, a container has only a 50% chance of leaving on schedule.

- The main export product from Europe and the USA is ... air (empty containers).

The share of vessels meeting their arrival date barely reaches 40%. Los Angeles, Savannah, Rotterdam, and Piraeus are among the most congested ports.

Port congestion, a legacy left by months of a global pandemic, is now part of everyday language in maritime transport.

With the back and forth in the restriction measures - not to mention the shocks that were the Suez Canal blockage, Yantian and Ningbo shut downs- port services are degraded and the waiting lines of ships off the world's main container ports are unprecedented.

On land, there is another / additional massive traffic jam: containers have piled up on docks.

Ship delays, coupled with the difficulty of repatriating containers, once they have been unloaded and brought into the hinterland, due to declining staff at ports and warehouses around the world, have atrophied the number of boxes available when the liveliness of demand would have required a rhythmic rotation.

AIRFREIGHT MARKET

Shanghai PVG airport:

The ground handling capacity of PVG airport is currently at a level of around 60%. The available workforce is mainly busy dealing with the backlog accumulated over the past few weeks.

Alternative airports like BJS, CGO, HKG have extreme problems coping with the additional tonnages rerouted.

It is to be expected that the situation in the handling process at these airports will worsen again over the next weekend.

Airports including HKG may take further action regarding stopping the acceptance of cargo or similar actions.

Today, a major game player, Air China, announced that all its flights were canceled to and from PVG. After 4 weeks following the disruption at PVG airport, demand for capacity (import and export) remains high and will increase from week to week.

Current customer demand in the relevant market has even increased by 30% compared to 4 weeks ago.

Warning: In the next few days it is NOT expected that the currently very limited number of direct flights to and from PVG will increase. For some airlines, the opposite will happen and further reductions in flights are being considered.

Besides, the local authorities have decided that all international cargo freight will no longer be accepted in the following Chinese airports:

SHE Shenyang / TAO Qingdao / SYX Sanya / URC / Urumqi / XNN Xining / FOC Fuzhou / KHN Nanchang / CGQ Changchung / SWA Shantou / WNZ Werizinou / NKG Nanking / HAK Haikou / CGO Zhengzhou

This decision will automatically have a direct domino effect on other Chinese airports’ activities and capacities

USA situation

Since Wednesday evening, New York City and the State of New Jersey have been experiencing very heavy precipitation from hurricane Ida. More than 400 flights were canceled in the New York City area (LGA, JFK, and EWR).

Cancellations affect both sides, imports, and exports. JFK was also affected by a few cancellations but is still in service.

In the Los Angeles area, over 44 vessels are at anchor, waiting in line to offload their containers.

Chassis shortages in the Midwest and Southeastern region and trucking capacity constraints are causing delays on all cargo as both steamship lines, and rail carriers struggle with high import volumes.

With the Covid Delta variant still spreading rampantly, the outlook of current high prices will continue through to 2022

With Peak Season upon us, all U.S. ports are seeing severe congestion with certain inland rail points leading to a tipping point.

In a nutshell:

The general situation regarding the interruption of the PVG continues to be extremely tense.

This situation is also NOT expected to ease significantly in the weeks or even months to come.

The combination of the accumulated delays, the increased customer production, and upcoming events such as Thanksgiving, Golden Week, and Christmas will lead to a sharp increase in demand.

UPDATE 8/12/2021

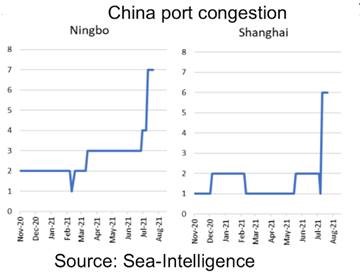

Ningbo and Shanghai, the world’s two largest ports, experience unprecedented congestion

Ningbo-Zhoushan and Shanghai ports handled 1.17bn and 510m tons in 2020, marking them out once again as the world’s top two ports.

The world’s two largest ports are experiencing unprecedented volumes of tankers, bulk carriers, and containerships back up into the East China Sea as a combination of renewed Covid cases, fierce weather, and strong US demand creates further supply chain havoc.

The Meidong Container Terminal in Ningbo suspended its operations on Aug 11th.

The two ports were hit hard by a typhoon late last month and have seen productivity slow as new anti-Covid measures are being carried out at most Chinese quaysides in the wake of the sudden spread of the Covid-19 delta variant over the past three weeks.

Besides, congestion is also hitting US ports of Los Angeles, Long Beach, Oakland, as well as Rotterdam, Antwerp, and Vietnam that are facing even more severe congestion than China’s big two ports.

In terms of Ningbo and Shanghai, this might be an early warning of the coming impact of more Covid restrictions in China, as the delta variant appears to continue to be present.

Since July 20, community-spread infections have been confirmed in roughly half of China’s provinces, sparking mass testing operations and local lockdowns.

Newly reported positive Covid-19 cases in China have recently forced the country to re-introduce restrictions to curb the spread of the virus.

Most ports in the country are now requiring a nucleic acid test (NAT) for all crew, with vessels forced to remain at anchor until negative results are confirmed.

Many ports in the country are also requiring vessels to quarantine for 14-28 days if they previously berthed in India or performed a crew change within 14 days of arriving in China.

While Ningbo and Shanghai have the most amount of ships at anchor waiting for berth space, the global container port congestion looks increasingly worse as the below map compiled today by eeSea shows – the bubbles indicating ships backing up across five continents.

Picture taken on July 10th showing the waiting line in Long Beach

UPDATE 7/14:

Here are the lessons to take from the first semester:

1 / The market tension is self-sustaining

Blank sailings, shortage of equipment, port congestions: little by little, generalized chaos is settling in the markets to become a new norm.

The notion of price is totally uncorrelated from the associated service, and the inflationary spiral on freight rates is spiraling out of control.

2 / The modal shift is accelerating but cannot meet all of the demand

The Railway Silk Roads are gaining momentum but only represent a small capacity per year. So this is a marginal solution that has shown its relevance, but it is not yet a "game-changer".

3 / Exponential Western demand keeps the bubble swelling

To use a buzzword, the "resilience" of American and European consumers is astonishing, in the current pandemic context.

While manufacturing to order becomes generalized, the increase in prices and especially the extension of delivery times to 2 or even 3 months do not seem to discourage demand from end consumers who continue to pay cash on order.

This trend is a novelty, undoubtedly encouraged by the development of e-commerce, which today completely and permanently disrupts purchasing behavior.

4 / The massive and rapid near-shoring did not take place

Even before the Covid-19 pandemic broke out, Western Supply Chain departments began to question the diversification of sourcing and near-shoring, to avoid too much dependence on China.

The pandemic could have given a boost to this movement. But it is clear that it has not.

China remains "the factory of the world", even though alternative sourcing is developing at the margins.

Despite the constant increase in the cost of raw materials, China remains unbeatable to this day on the prices for the majority of the consumed products.

5 / The post-Covid period is not yet insight

The prospect of a rapid return to the "world before" is receding, with new variants and the alternation of deconfinement / reconfinement / lockdowns and lockdowns liftings. Without a global planetary approach, and not by area or by hemisphere, it now appears impossible to overcome the pandemic. Economic players must deal with this uncertainty.

****

What to expect for the second semester?

Three possible scenarios for the evolution of containerized maritime transport:

1 / The inversion of the balance of power

This scenario is moving away, at least in the very short term. On one hand, because of the massive injection of liquidity into Western consumption to contain any social explosion, and on the other hand, due to the lack of alternative options.

The effects of the FAK rate announcement of $ 20,000 on the 40 ’between Asia and Europe from July 1st is a life-size" stress test "for our economies.

At best, the trend is indicative of momentary overheating. At worst, it announces a risk of a rapid slide into a much more serious situation, hyper-inflation leading to the infernal triptych of rising credit rates, rising public and private debts, and the erosion of the power of purchase.

This economically dark scenario must be taken seriously. This remains unlikely, but the risk is not zero in a context of political tension with China and a global pandemic still far from being under control.

2 / Shipping companies keep control

This is now the most likely scenario for the second half of the year.

Shipping companies are the first to know this, and the call for relative wisdom is gaining ground. The challenge now is to land the market smoothly but at high levels, i.e. 5-digit FAK rates by 40 ’on major trades.

The port congestion in the Greater Shenzhen area has not been fully resolved and the container shortage in southern China remains a fundamental problem.

3 / Political regulation

So far, the trade policies of shipping companies are not scrutinized too closely by regulatory authorities. Overall, this third scenario therefore lost its credit during the first half of the year.