AIR FREIGHT

The air freight market should experience a classic period of calm from now on.

The Chinese New Year caused a marked rebound in activity, perhaps slightly amplified by the modal shift from the ocean to the air due to the crisis in the Red Sea.

In any case, the sector is doing well.

Beginning 2024, global demand was 19% higher than in 2022, according to WorldACD, with even +42% for exports from the Asia-Pacific region.

The increase in freight rates, however, has not been proportional; prices remained around 20% below their 2022 YoY levels.

SEA FREIGHT

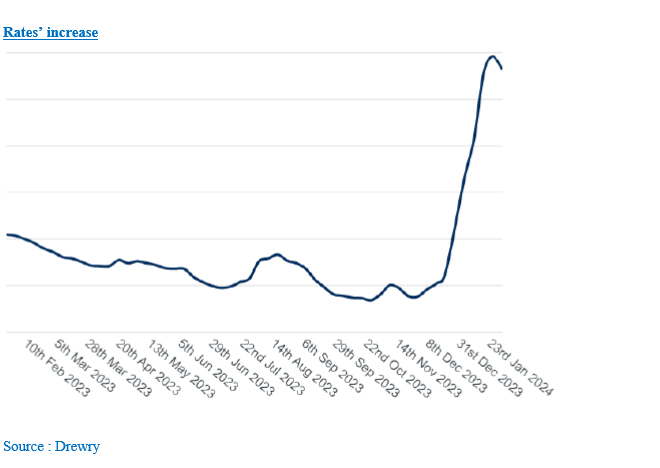

2024 started with high freight rates; however, the increase was half as high as the one experienced during the post-Covid peak.

The most likely scenario is that companies will want to cover the increase in transport costs linked to the bypass of Africa by maintaining rates, both spot and contractual, at a high level.

The great uncertainty remains on the level of demand for maritime freight, in a year where the global economy is hesitating between recovery and stagnation.

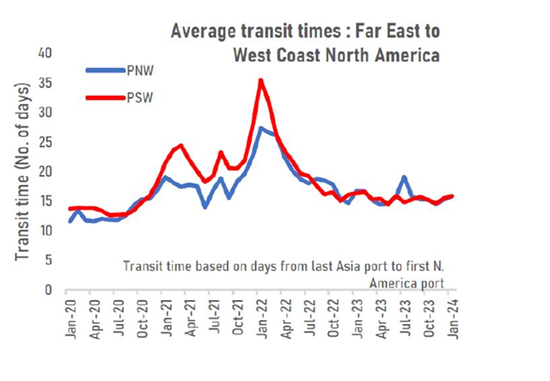

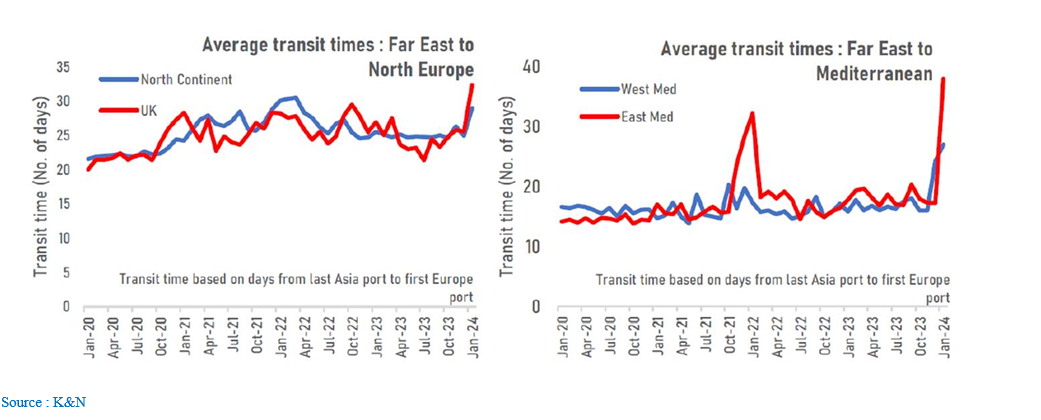

Threats and attacks on vessels in the Red Sea (ships supposed to transit via the Suez Canal) and the severe drought conditions in the Panama Canal continue to have a significant impact on global maritime freight transit times and costs.

Although more capacity has been released, current volumes cannot meet current demand.

Since February 1st, 80% of all container ships (or more than 300 vessels) using the Suez route have diverted to the Cape of Good Hope.

This figure is expected to increase as more ships continue to divert.

This rerouting results in an extension of transit time from 7 to 14 days and a 15-20% increase in the cost of surcharges.

If the impact is mainly felt on Asia-Europe trade, it also has repercussions on transpacific routes.

Restrictions on the Panama Canal have already led to diversions to Suez, which now is almost inaccessible, and vessels need to pass through the Cape of Good Hope.

Capacities :

All of the above will result in increased transit times and price volatility for shipments between Asia and Europe and between Asia and the US East Coast.

The availability of container equipment is expected to be insufficient by March 2024.