The 2026 global shipping market is defined by a paradox: a record of 10M TEU’s of new sea freight capacity is set to pressure rates lower, while tariff barriers, energy risks, and geopolitical tensions make supply chains more complex than ever.

This market update explores current trends in air and sea freight, taking into account the impact of evolving customs policies, trade disputes, and geopolitical uncertainties.

AIR FREIGHT

Air cargo spot rates globally, and from Asia Pacific origins in particular, have continued to edge upwards into the second half of November, despite a slight dip in demand from China and Hong Kong to the US.

Analyses indicate that for the first 10 months of 2025, average worldwide air cargo tonnages were +4% higher than in the equivalent months last year, with Asia Pacific origins recording a +7% YoY increase for the year to date.

On the pricing side, average worldwide rates for the first 10 months of this year were more or less equivalent to their level last year.

The global air cargo market is adjusting rapidly as U.S. tariff changes and evolving trade priorities redirect Chinese export flows.

While the China–U.S. corridor remains active, capacity and pricing pressures are intensifying, and Europe and the UK are emerging as major beneficiaries of diverted volumes.

Airlines are prioritizing high-yield cargo out of Asia, and capacity may tighten on select lanes from North America to Australia, Singapore and South America.

Asia’s air freight markets continue to experience strong peak season demand, which is expected to persist through December and extend into early January.

OCEAN FREIGHT

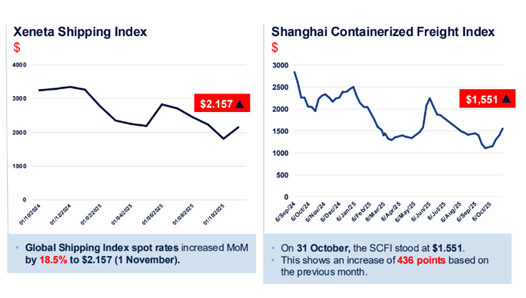

The container market is oversupplied, but strategic capacity control has let carriers push GRIs through in October and November.

Also, global schedule reliability is improving, and capacity is slowly being reinstated on eastbound Trans-Pacific routes but still tight for North America, exporters shipping westbound and to Europe.

Uncertainty over scheduled and threatened U.S. tariff increases on Chinese goods for November prompted some shippers to move cargo earlier than usual.

As an effect, a new round of rate increases took effect on November 1st, though their sustainability remains uncertain with new vessel deliveries scheduled before year end.

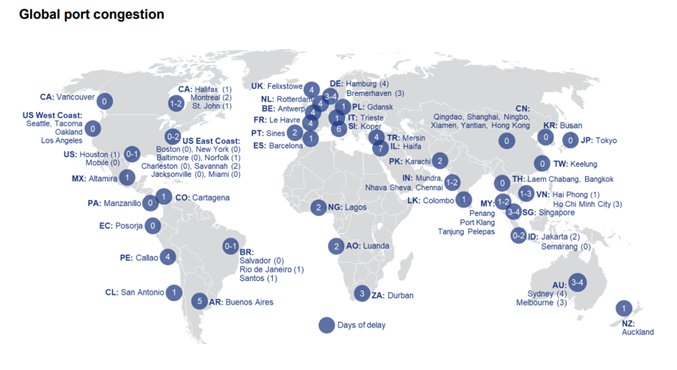

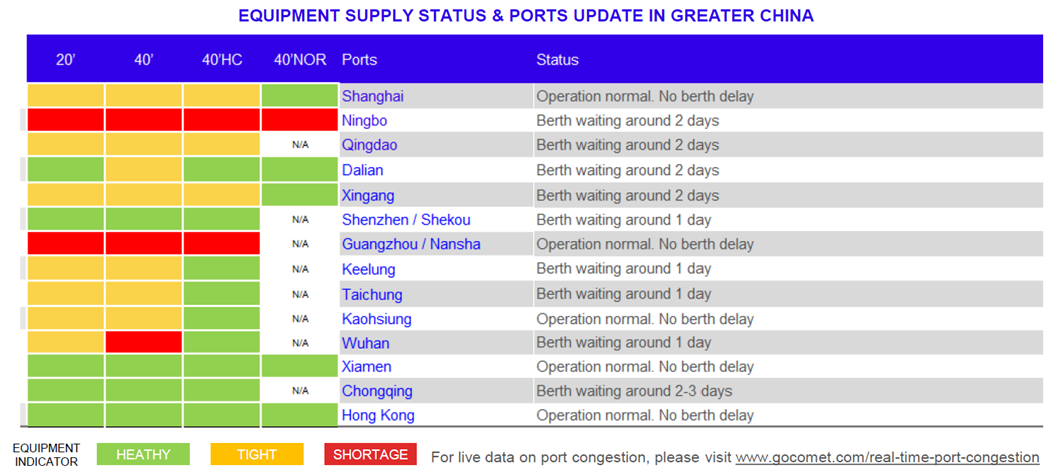

Besides, port congestion is emerging as a long-term structural challenge: recent industry data and expert discussions suggest that port congestion is developing into a long-term structural issue for global trade.

The main causes include vessels arriving off proforma schedules—creating cascading delays—and ship sizes growing faster than ports can expand berth and yard capacity.

The Container Port Performance Index has continued to rise since late 2024, reflecting longer port stays and operational bottlenecks.

According to S&P Global Market Intelligence, congestion pressures are likely to increase as 162 new vessels exceeding 18,000 TEU are on order, supplementing the 202 ships of

that size currently in service.

For shippers, the implications are significant: longer port stays and transit times extend lead times, disrupting sales forecasts and planning cycles.

Increased delays also necessitate larger inventory buffers, tying up working capital. Furthermore, congestion effectively removes capacity from the market, much like geopolitical disruptions, driving rate volatility and temporarily benefiting carriers struggling with overcapacity.

To minimize risks, one may want to review inventory strategies, lead time planning, and routing options.

Additionally, ocean shipping lines are not expected to make a quick return to the Suez Canal after Houthi militia announced an end to attacks.

Since 2024, the air cargo industry has benefited from container shipping lines needing to sail around the southern tip of Africa on their way to Europe, rather than through the Suez Canal, which has extended transit times from Asia by weeks.

Industry commentators have warned that when shipping lines return to the Suez Canal route, volumes are likely to shift back to ocean shipping, hitting growth expectations.

However, market analysts also think that ocean shipping is likely to only slowly shift back to the Suez Canal for a number of reasons, which should at least avoid any sudden shocks for air cargo and crew safety would be the number one concern for ocean shipping lines.

A return to the Suez Canal route could also release a flood of capacity back into the market and cause “freight rates to plummet” which could in turn cause disruption as shipping lines take urgent actions, such as suddenly cancelling sailings and slowing down ship speeds, to correct the situation.