UPDATE 9/15/2022

AIR FREIGHT

While a tremor of air peak season is likely in the days and weeks to come, the situation between China and the United States, in diplomatic cold, weighs.

The cancellation of flights on both sides will reduce transpacific capacity, which could have the effect of increasing rates and operational difficulties on this route.

Besides, the high season remains uncertain due to various factors:

- Contraction of production activity, mainly in Germany and the United States

- Inflation rate and high inventory levels in western countries

- Geopolitical tensions in Asia (Taiwan) and Europe (Ukraine)

- The global aircraft load factor is below 50% for the first time since the start of the pandemic.

SEA FREIGHT

This was the big lesson of the summer: the maritime transport sector is indeed experiencing a turnaround: everywhere, except the transatlantic axis (read below), rates continued to fall, without a peak season.

An exception to the picture: rates on the Europe-United States axis have been climbing since the start of the year, by around +25%.

It is therefore now cheaper to ship a container between China and the United States via the Pacific than between Northern Europe and New York!

The explanation lies in two realities: American demand for European goods is sustained and port congestion continues on the East Coast as in Europe, affected by strikes.

Faced with low demand and excess capacity, shipping companies are reactivating blank sailings.

On the Asia-Europe trade, the most affected by the loss of activity, CMA CGM will cancel 5 crossings in October, the 2M alliance (Maersk and MSC) will remove 10% capacity until Golden Week and THE Alliance up to 18%, with 10 routes removed.

In total, around 9% of the total capacity on the Asia-Europe trade will disappear over the next 12 weeks, while no peak season is taking shape.

The companies are working to curb the fall in rates, which continues at a good pace.

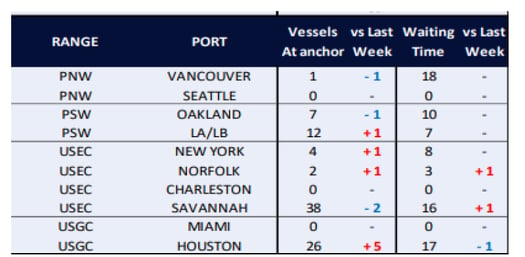

Following a period of record congestion across terminals at the USA East Coast twin ports of Los Angeles and Long Beach in January which saw 109 vessels queuing awaiting berth, the backlog is now almost clear as we enter September with only 8 vessels queuing w/c 29th August.

In the meantime, equipment challenges and uncertainty caused by potential labor strikes pushed many vessels to use ports along the East Coast such as New York and New Jersey.

Remember: the imbalance of flows and the management of empty containers had been one of the main sticking points during the post-lockdown economic rebound.

The extreme difficulty of returning accumulated empty containers to Asia even played a major role in the explosion of rates.

Except that the question is far from settled, after a record number of new containers have been injected into the circuit since 2020: in 2021 alone, box manufacturers produced 6.6 million TEUs.

Today, demand is falling and empty boxes are piling up: if transport time normalizes in early 2023, there will be a release of 4.3 million TEUs of excess containers in North America.

This could overwhelm empty container depots in the United States, a problem that is already starting to materialize.

This will also have an impact on blank sailings, as shipping companies are caught in a dilemma: cut crossings (at the risk of seeing empty boxes block Western ports) or limit blank sailings (and thus accelerate the drop in rates).

This puzzle will, in any case, have concrete repercussions for shippers.

UPDATE 8/28

AIR FREIGHT

The air cargo market remains flat as the industry heads towards the traditional peak season.

Data provider TAC Index said that its latest figures showed that overall airfreight rates according to the Baltic Exchange Index (BAI) were last week down 0.8% compared with the prior seven days.

Prices did not move much from most major outbound locations, with Shanghai showing the biggest gain (against a week before) of 2.4% taking the year-on-year change from there to 13%.

As the inventories continue to remain high and China still not fully re-opened from Covid lockdowns, it has been predicted that other countries in the Asia Pacific would report an increase in rates.

SEA FREIGHT

Transpacific ocean rates have continued to decline, but remain well above 2019 levels.

Though demand for goods has dropped somewhat, it remains high, as does port congestion.

Port congestion continues to haunt global trade, spreading fresh fears among exporters and importers over whether massive amounts of cargo will be delivered on time for the busy, year-end shopping season.

Supply chains never fully recovered from the pandemic shock when goods transported by sea were delayed and shipping prices soared.

In Europe, ports are backed up because dockworkers are on strike or vacation as ships queue up, and there is an acute shortage of truck drivers.

In the U.S., a shortage of rail capacity and warehouse space means boxes remain in ports for too long.

The workers’ strike at Felixstowe port will likely increase congestion and delays for UK logistics and put pressure on alternative European ports.

Due to the lack of available warehouse space in some locations, importers are using containers as additional storage units.

This is impacting equipment flow forecasting and so resulting in shortages in equipment and chassis, especially inland when added to the terminal congestion.

Port congestion in Europe has been on the rise since May: Rotterdam, the Dutch port that is the continent’s largest, is struggling with a shortage of truck drivers and many containers that were destined for Russia but are stuck at the harbor under sanctions.

In Hamburg, Germany’s biggest port, a series of work stoppages earlier this summer left scores of boxes uncollected, and workers have threatened to strike again in the fall.

German port employers and the union representing dockworkers have reached an agreement on wage increases, ending a long-running dispute that has heavily disrupted operations at some of the country’s busiest container ports.

UPDATE 8/5

SEA FREIGHT

- Rates are mostly extended or slightly reduced for the end of July.

- Capacity/Equipment: global space begins to fill up again.

- Congestions in European ports cause a delay in returning ships to Asia, leading to further delays and the cancellation of some vessels.

- Los Angeles and Long Beach: vessel wait times are 14 to 17 days due to shipyard congestion, the surge in imports, and labor shortages.

The question of the future evolution of maritime freight rates agitates observers, while the tariff peak has been exceeded and a “muted” peak season seems to be occurring.

The beginnings of a consensus are emerging: prices should continue to fall, before stabilizing at an intermediate level (between the historic low before 2020 and the record highs of 2021).

If demand returns to standard levels, port and land congestion in Europe and the United States is a concern because they persist despite the drop in volumes in circulation and have a negative impact on capacity.

Abnormal retention of empty containers is observed in Europe, where the drought also limits river traffic.

The German ports, but also Rotterdam and Antwerp, are in the red.

Fewer empty boxes sent back to Asia has serious consequences on the fluidity of the East-West trade lane.

AIR FREIGHT

Between high inventories, inflation and consumption redirected towards leisure and services, the pressure on air freight continues to decline.

As a result, seasonality phenomena are reappearing after two extraordinary years.

Currently, the sector is going through the traditional weak summer season, before a probable moderate peak season at the start of the school year.

But in such an unstable economic and geopolitical context, forecasting remains a risky exercise.

On the side of certainty, the decrease in air freight rates continues: the TAC Index posted a sharp decline last week (-5.5% in China-Europe).

In Asia, observers are reporting significant rate cuts, albeit still at levels around 15% higher than in 2019.

Airfreight rates on key trade lanes were stable in July for the quieter summer period but remain far above pre-pandemic levels.

The latest data from the Baltic Exchange Airfreight Index (BAI) show that average rates on services from Hong Kong to North America dropped by 2.6% in July.

However, rates on the trade are up 7.5% on the year-ago level and far ahead of the rates recorded for the month in pre-pandemic 2019.

There was a similar trend in services from Hong Kong to Europe where rates in July increased by 1.3% in June.

But rates on the trade are up by 38.4% compared to last year and are much higher than those registered in July 2019.

The flattening of rates compared with a month ago reflects the seasonal summer slowdown ahead of the peak season towards the end of the year.

UPDATE 7/21

AIR FREIGHT

Transportation rates are expected to stay above pre-pandemic levels for the foreseeable future despite the recent slowdown in demand. This slowdown has been caused by rising inventory levels, inflation, and the return of spending on services as opposed to goods in certain sectors.

However, the industry is likely to experience a peak season this year, and volumes are still ahead of pre-pandemic levels -supply chain disruptions continue.

Despite a slowdown in demand compared with the last two years, rates are likely to stay at an elevated level due to supply chain disruption caused by labor shortages, possible Covid restrictions, capacity shortages, the war in Ukraine, and ongoing port/airport congestions.

Besides air cargo capacity will be reduced when the summer travel season comes to an end.

It is highly suggested to advise clients not to expect rates to revert to pre-pandemic levels in the short-, medium, or long-term.

And it is important to consider that when thinking about next year’s budgets.

SEA FREIGHT

The summer peak season is finally looming, but very timidly (freight rates stabilized this week, according to the World Container Index). Several observers, but also the company Maersk, believe that demand could quiver in August.

In the meantime, consumption is slowing down and so is maritime traffic. This has made it possible to partially reduce port congestion, especially in China. On the other hand, it continues to worsen on the East Coast of the United States and in Europe. Some even believe that congestion is now more serious in certain European ports than in California…

As a matter of fact, in Hamburg, Antwerp, Rotterdam, or Le Havre, boxes are piling up and no one sees the end of the tunnel.

In the question: a lack of truck drivers and disruptions on the rail or river networks.

In France (Le Havre and Fos), Hapag-Lloyd has even added a €25 congestion surcharge since July 1st to try to speed up the pick-up of waiting containers.

Finally, the phenomenon is aggravated by the low punctuality of ships (barely a quarter of them arrive on time from Asia)...

Summer will be hot in Europe!

Besides, in the wake of a breakdown in negotiations between employers and the union, 12,000 dockworkers in the German ports of Bremerhaven, Wilhelmshaven, and Hamburg have gone on strike.

In just a matter of a few weeks, the German ports are now bracing for a third strike as a dispute over wage increases continues to threaten the cargo operations in all major Northern ports including Hamburg, Bremerhaven & Wilhelmshaven.

The strike started on July 14th, 2022 was scheduled to continue until Saturday, July 16, 2022.

This 48-hour strike came after the sixth round of wage negotiations ended without a result.

The continued port congestion has impacted the rail lines leading them to cancel services in & out of the ports thus further straining the traffic via Germany’s main ports.

In the USA, rapidly approaching peak numbers, the pileup of import containers waiting on Los Angeles and Long Beach terminal yards is getting out of hand.

Having just crossed the number of days (nine) that the import containers can sit on the terminal, Long Beach has crossed a red line that could result in Container Dwell Fees being applied should things continue the way they are.

UPDATE 7/8

AIR FREIGHT

Many had expected the opening up of Shanghai and Hong Kong following strict Covid lockdowns to result in a surge in rates from Asia as factories played catch up following months of closure.

However, TAC Index figures show that rates declined marginally in June compared with May from Hong Kong to Europe and North America and from Shanghai to North America, while there was only a slight increase from Shanghai to Europe.

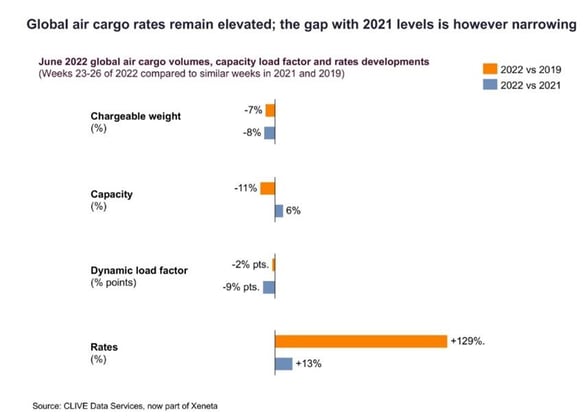

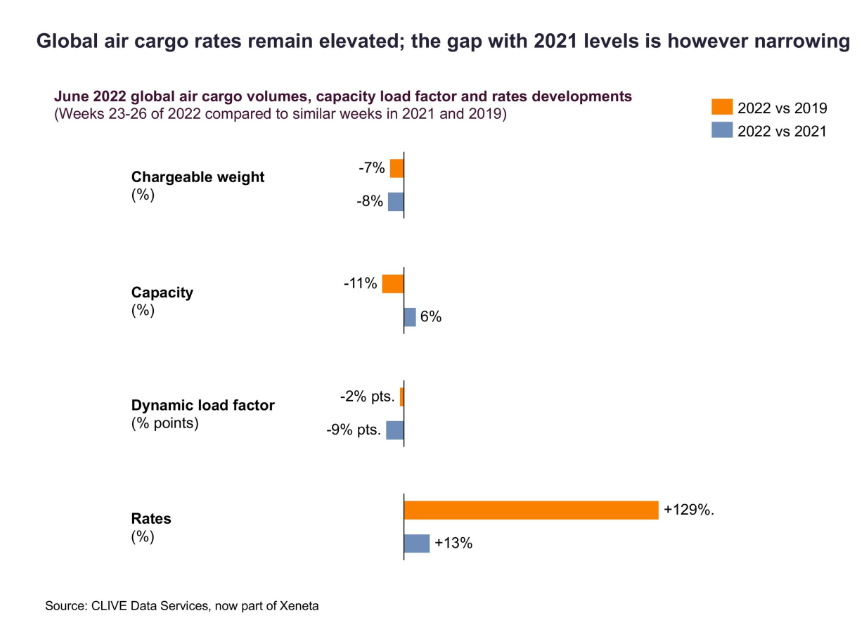

Air cargo demand declined compared with a year ago for the fourth month in a row in June, according to the latest statistics from CLIVE Data Services.

Figures from the same source show an 8% year-on-year decline in chargeable weight in June, following on from drops in March, April, and May.

The dynamic cargo load factor – taking into account weight and volume – for the month was nine percentage points behind last year at 59%.

The load factor decline comes as demand fell and carriers continued to add capacity – up 6% on last year – to cater to returning passenger demand.

Despite the weakening supply and demand conditions, rates for the year were up 13% compared with the same month last year, although there was a decline compared to May.

SEA FREIGHT

Most experts predict that global port congestion is set to continue until at least early 2023 and keep spot freight rates elevated.

The COVID-19 outbreak has lengthened ship delivery times since 2020, pushing up freight costs, while the Russia-Ukraine conflict and lockdowns in Shanghai have added to supply chain disruptions this year.

Rotterdam is filling up with empty containers, creating an even bigger shortage in Asia, and causing more backlogs that are slowing down the ports.

The Dutch port is unable to deliver goods at the export hub, forcing ocean carriers to prioritize shipments of filled boxes, adding to the problem.

Cargo must be booked at least one month in advance.

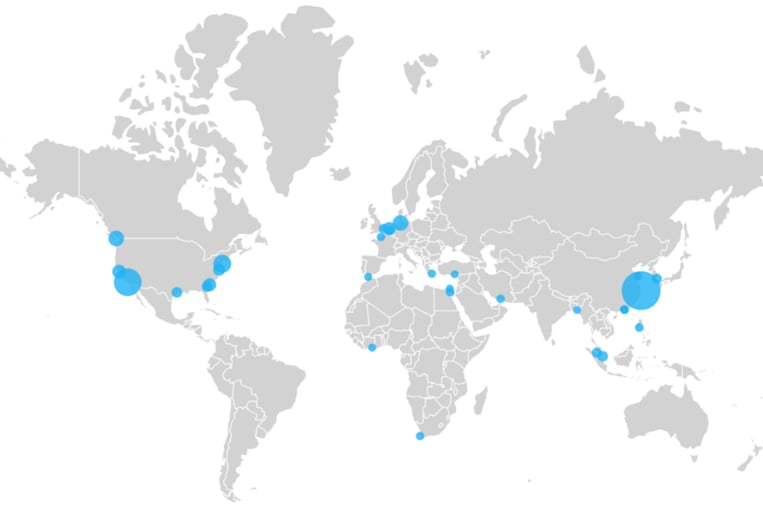

Overall, major ports around the world are more or less congested, which creates long-term supply chain bottlenecks.

CUSTOMS IN EUROPE

The European Commission (EC) is urging the air cargo industry to prepare for new rules that from March of next year will require the submission of advanced shipment information before air cargo is loaded.

The EC said that the new rules mean that all freight forwarders, air carriers, express couriers, and postal operators transporting goods to or through the European Union (EU), including Norway and Switzerland, will be required to submit in advance cargo information in the form of a complete entry summary declaration (ENS) as part of the second phase of the new customs pre-arrival security and safety program – Import Control System 2 (ICS2) Release 2.

The EC said that companies are strongly advised to prepare in advance for Release 2, to avoid the risk of delays and non-compliance.

The information previously needed to be submitted four hours before arrival, but will now need to be input before shipments are loaded onto an aircraft.

To help prepare for the introduction of ICS2 Release 2, the European Commission will make available a conformance testing environment from July 2022 until February 2023, to be able to verify the economic operator’s ability to access and exchange messages with customs authorities through the intended ICS2 trader interface.