AIR FREIGHT

According to air cargo experts, the current peak season is tending to slow down.

Rates have stopped increasing in recent days or are even starting to decline.

This is good news for shippers, as prices have risen sharply in recent weeks, and access to capacity has become complicated, particularly from mainland China and Hong Kong, but also on the Transatlantic.

Air freight rates out of Shanghai increased by 8% in November, recalls Drewry.

LITHIUM BATTERIES / AIR FREIGHT

With constantly increasing volumes transported, lithium batteries constitute a major source of concern (and accident) for international transport.

Recently, a group of experts from the International Civil Aviation Organization (ICAO) decided to strengthen the rules for the transportation of lithium batteries by air.

This concerns lithium-ion batteries with a nominal power greater than 2.7 Wh packed alongside their equipment.

The SoC (state of charge) must be at a maximum of 30% of the nominal capacity, a rule that already applies to batteries shipped alone.

Exceptional authorizations may be granted, but subject to approval by the States of origin and destination authorities.

This new rule should be integrated into the 2025-2026 edition of the ICAO technical instructions.

It will, therefore only become mandatory from January 1, 2026.

As far as lithium batteries are already installed in their equipment, the rules will remain more flexible.

The 30% SoC will only be a recommendation and not an obligation.

ICAO experts justify this distinction by explaining that the battery is, in such a configuration, better protected by the device which contains it.

SEA FREIGHT

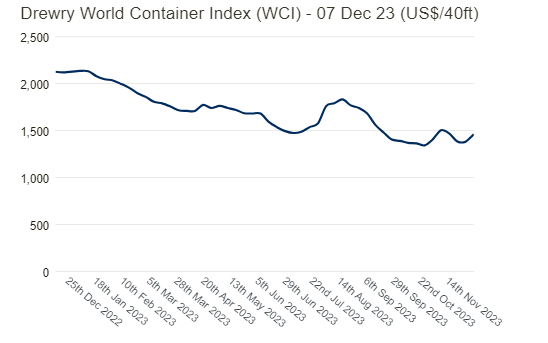

4.9 days is the average delay of container ships in October, up slightly compared to September (4.6).

The punctuality rate of ships still cannot return to its 2019 level: 64.4% vs. 78%.

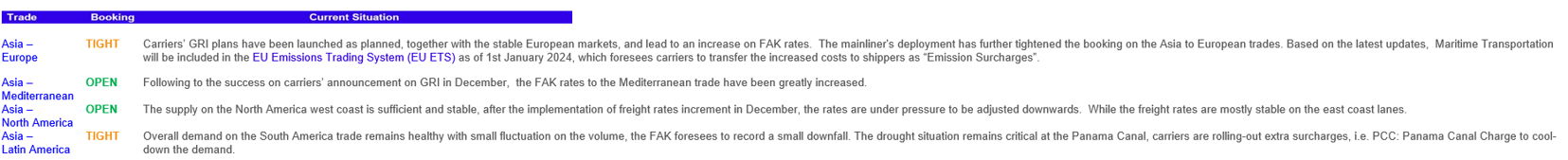

In a nutshell, the sea freight market is going through several adjustments at the same time: increase in capacity, increase in lead times, and stable demand : sea freight companies are trying to adapt their strategies in order to keep making profits and their strategies in reducing capacities via blanck sailings is paying off with a slight increase in rates.

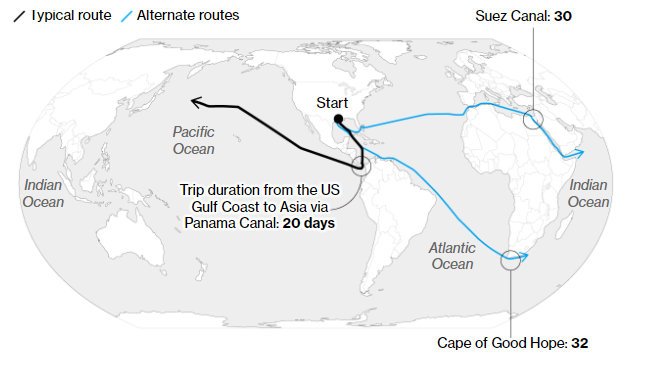

PANAMA CANAL

For more than a century, the Panama Canal has been a catalyst for consumer goods and raw materials flowing between the Americas, Asia and beyond.

Climate change is now a chokepoint.

A severe drought is reducing water levels in a nearby lake used to manage the depths for cargo ships passing through its locks.

That led to tonnage restrictions and fewer vessels transiting the shortcut each day, causing delays.

Those unwilling to wait have two options: pay hefty fees to jump the queue or sail a much greater distance around South America, Africa or through the Suez Canal.

Each choice adds cost at a time when governments around the world are struggling to tame inflation.

And the bottleneck will only worsen in the coming months as Panama enters its annual dry season, which typically begins in December and lasts until April or May.

CARBON TAX

As of January 1, 2024, and in accordance with a directive from the European Union, shipping emissions will be integrated into the European carbon market.

This means that shipping lines will have to buy or surrender enough allowances to cover the Co2 emissions of ships calling at European ports.

The European legislator's aim is to gradually reduce carbon emissions from maritime transport while encouraging the emergence of alternative maritime fuels.

The acquisition of these quotas by sea freight companies will generate an additional cost, which will ultimately be passed on to ship users in the form of surcharges.

These extra costs, which vary according to Shipping lines’ commitments, will be subject to change in line with regulations.