AIR FREIGHT

Airfreight rates in January climbed as the month progressed due to the approaching Lunar New Year holiday and anecdotal reports of a move from sea to air due to the Red Sea crisis.

The latest figures from the Baltic Exchange Airfreight Index (BAI) show that in the last full week of January rates from Hong Kong to North America climbed 8.4% on a week earlier; from Hong Kong to Europe prices last week were up 4.5% week on week.

With a transit time from Asia extended by 10 to 15 days to Europe and the imminence of the Chinese New Year, a temporary modal shift from the ocean to the air was expected by experts.

According to the latest indicators, reports show that tonnages transported by air freight increased by 24% during the week of January 8-14, compared to the previous week, which could reflect some modal shift towards air transport due to disruptions in maritime transport.

Over the last fortnight, demand has particularly increased on China-Europe trades – where experts see significantly increased rates but also delays – while it tends to decrease towards some other destinations.

Sea-air multimodal via Dubai is also increasingly popular.

The increase is in line with expectations that rates may spike following disruption to ocean shipping in the Red Sea, though sources also point out that rates often rise in the runup to Chinese New Year.

SEA FREIGHT

The global maritime trade supply chain continues to face disruptions caused by the prolonged crisis along the world’s largest trade route through the Red Sea and Suez Canal.

Over the last weeks, the Houthi insurgents attacked several container vessels within the Bab al Mandeb Strait, which is leading to suspension or reroute operations from almost all carriers.

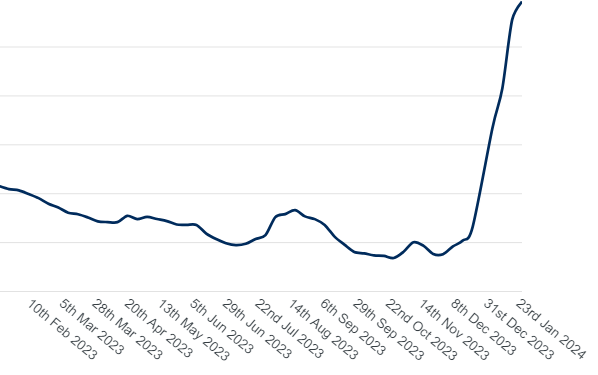

262 container vessels in this area have been affected so far, which in turn reduced the Suez passage utilization by 61%.

Due to the sustained instability, major shipping lines continue to circumvent the region, opting for the longer route around the Cape of Good Hope in South Africa.

However, this route has considerably lengthened transit distances, increasing time and costs for ocean freight transport.

The Suez Canal disruption, coupled with ongoing challenges in the Panama Canal due to low water levels, has further complicated the global shipping situation.

The Cape of Good Hope route, with an average transit time increase of 14 days, has become the primary alternative route.

Additionally, the approaching Lunar New Year is expected to intensify delays, as increased exports precede the traditional holiday shutdown across Asia.

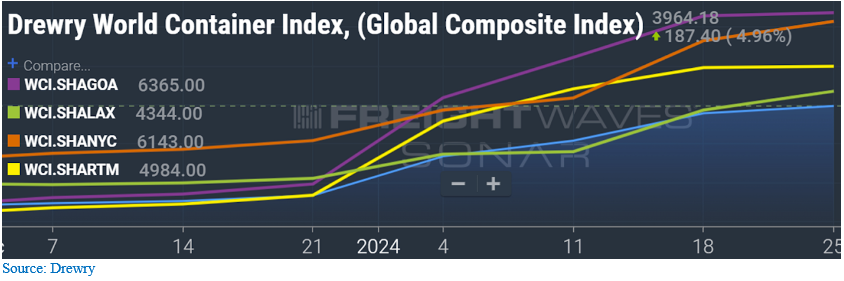

Severe capacity shortages are expected on Asia-Mediterranean trade lanes, with spot container rates surging.

It’s a massive diversion that’s delaying delivery of billions of dollars in goods, adding to costs and carbon emissions, and fueling fears of broader economic fallout.

Major effects like capacity squeezes and rate surges are observed on the main trade lanes affected, especially Asia-Mediterranean routes, where container spot rates jumped by 157% in just a month.

New vessels with additional capacity are expected in the first quarter of 2024, with the hope of stabilizing rates and coping with shortages.

As a result, global supply chains and markets are struggling with shipment delays, squeezed capacity, and equipment shortages, with some companies having to stop the production of specific products due to component shortages.

The rate dynamic now is very different than in the pandemic boom: the 2020-2022 supply chain crisis was driven by demand, as consumers bought more goods amid the pandemic.

The current rate surge is driven by supply.

RAIL ROAD FROM ASIA TO EUROPE

In a nutshell, the railway market has been under strong tension since the end of 2023, resulting in increasingly restricted spaces and congestion due to the events taking place in the Red Sea combined with the pre-New Year Chinese (“Year of the Dragon” begins on 02/10/2024).

For information, the current average transit time from the main Chinese rail terminals to the Duisburg Terminal (Germany) is around 18-20 days.

Rail obviously remains an option. However, it is highly recommended to work on specific studies based on precise packaging with a date of availability and not on standard studies, considering the current market's complexity.