UPDATE 3/3

Please find below the latest update on the WW transportation market (focus on sea freight this month):

One can say that the complex years follow one another for the freight transport sector.

After the COVID 19 pandemic and its unprecedented impact on the activity, 2022 was marked by the Russian-Ukrainian conflict, the effects of which are fully felt at all levels of activity.

As 2023 has begun against the backdrop of a lot of uncertainties and not very optimistic economic prospects, on the part of the ordering party as well as that of the carriers, here are the main concerns from the market (sea freight).

In the first two months of 2023, the global supply chains have continued to ease for the transport sector as a whole.

Due to the recession-related slowdown in consumption demand, there were no capacity bottlenecks or price increases even before the Chinese New Year, and the restart of production in China is proceeding at a correspondingly moderate pace.

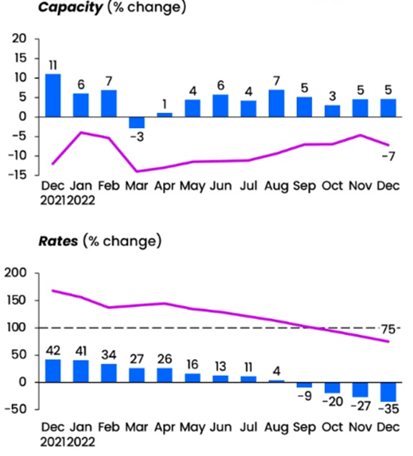

As a result of the carriers' blank sailing programs, capacity is being tightened in ocean freight on many trade routes to counteract falling demands and rates.

In Europe, there are sporadic operational challenges in logistics due to strike actions in France, Finland and Germany, but these are not having a long-term impact.

Rising inflation, strike threats and slowing demand triggered a wave of business uncertainty following months of expansive growth.

Although the situation surely has changed, the macroeconomic outlook for 2023 continues to darken.

The war in Ukraine approaches its one-year mark and a slowdown in China affects global economic growth.

High inflation and surging oil prices further dampen hopes for a quick recovery.

Despite an easing of China’s zero Covid policy in December, which affected major manufacturing and exporting centers, and caused exports to drop sharply, the year starts on a somber note for both air and sea.

The shipping industry is facing a hard landing in 2023 as both cargo demand and spot ocean freight rates from Asia plummet, forcing carriers to restructure their services.

The three vessel-sharing alliances have canceled 53 Asia-Europe westbound sailings in the first seven weeks of this year.

This represents 27% of their original scheduled capacity. Carriers may decide to cancel more sailings if demand is worse than expected.

During the eighth week (20 February - 26 February) and the 12th week (20 March - 26 March) of the year, 71 canceled sailings were announced throughout the Transpacific, Transatlantic, and Asia-North Europe & Mediterranean trades, indicating a 10% cancellation rate.

65% of the blank sailings will be in the Transpacific Eastbound traffic, 28% in Asia-North Europe and the Mediterranean, and 7% in the Transatlantic Westbound trade.

THE Alliance (Hapag-Lloyd, Yang Ming, ONE and HMM) has announced 43 cancellations for the next five weeks, followed by OCEAN Alliance (CMA CGM, COSCO, Evergreen and OOCL) and 2M (MSC and Maersk) with 12 and 4 cancellations, respectively.

Meanwhile, 12 blank sailings were deployed in non-alliance services over the same period of time.

Following the period of extensive blank sailings and service suspensions over Chinese New Year (21 January – 20 February), there shall be fewer cancelled sailings in March than seen over the July 2022-February 2023 period, resulting in more capacity being released.

All these cancellations, blank sailings, or unexpected stops in ports for transshipments, however, are very difficult to claim because of:

- lack of regulation of delay-related claims by Hague Rules;

- the terms and conditions clauses of the bill of lading, which are considered as the contract terms, rejecting or limiting the compensation to a minimum.

The terms and conditions which are applicable to the bills of lading issued by the carrier have clauses like “the carrier can take the liberty to discharge the cargo at any port…”, “the carrier does not undertake that the cargo shall meet any particular market…”, “the carrier does not undertake that the cargo shall arrive at the port of discharge” and most relevant for the question of liability: “the carrier shall in no circumstances whatsoever be liable for direct, indirect or consequential loss or damage caused by delay…”.

In other words: did your Christmas trees arrive on 5 January instead of 30 days earlier or was your container with pineapples from the Philippines discharged in Jebel Ali instead of Le Havre, you can’t blame the carrier for it.

UPDATE 1/6

In 2022, the challenges have been characterized by ongoing disruptions in international supply chains.

Unreliable schedules, congested ports, equipment, and capacity shortages created tension in the ocean freight business and temporary all-time high rates.

During the year, inflation rose sharply in many countries around the world, and due to the situation in Ukraine, energy costs increased as well.

This led to weakened and shifted consumer behavior in parts of Europe.

In 2023, additional ocean freight capacity is expected with the launch of new vessels, whilst the new IMO regulations and carriers' blank sailing programs will have an opposing effect.

AIR FREIGHT

Air cargo association Tiaca is predicting another tough 12 months for air cargo demand, but has also outlined positives for the industry.

In its latest newsletter, the association said that high inflation, high-interest rates, high energy costs, and concern over job security have compounded to create an air of defensive consumer spending, which is in turn affecting the air cargo industry.

However, the association believes that the current situation is temporary and hopes that later in 2023 central banks will start reducing interest rates when inflation is considered to be under control.

In any case, even though capacities have improved throughout 2022, rates for 2023 might still be above pre-Covid levels.

SEA FREIGHT

One certainty at the start of the year: operational fluidity is almost back on major trades but is far from being back to “normal” and to comfortable levels.

The latest punctuality statistics published by Sea-Intelligence only confirm this.

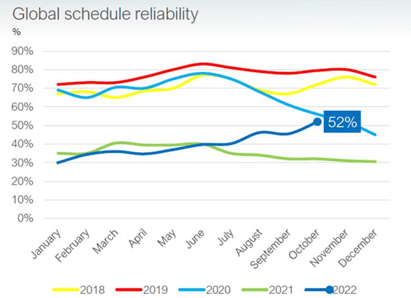

In November, more than 56% of services arrived on time, the highest reliability rate since August 2020.

MSC has the highest scores, according to the analytics firm.

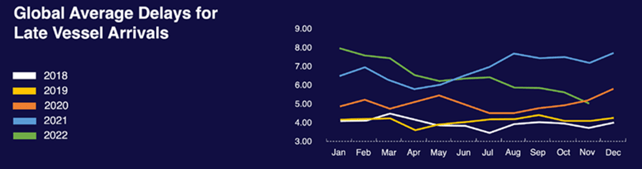

More concretely, the average delay of container ships has fallen to just over 5 days, compared to 7.95 days at the height of the transport crisis, in January 2022 (-37%).

The average over the pre-pandemic period 2018-2019 was 4.05 days.

Even in the United States, the ports on the East Coast are seeing their level of congestion go down, while it is almost nil on the Pacific coast.