AIR FREIGHT

There has been an increase in demand for technology products due to new product launches as the year-end holidays and gifting season approach.

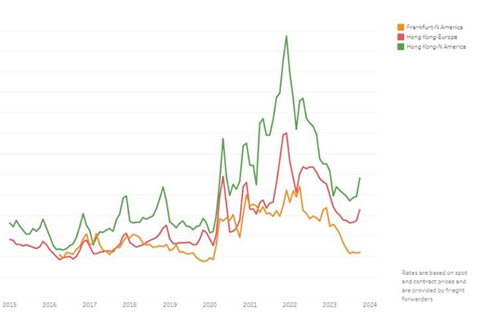

This, combined with the existing high ecommerce demand, has led to tight capacity—and increased rates—on specific trade lanes, especially from Asia to Europe and North America.

This trend is expected to continue into next month.

Growing demand for air freight, particularly from China to Europe, has continued to push spot rates upwards over the past six months, according to global indices such as the Baltic Air Index (see chart below).

Golden Week at the beginning of October marked a logical halt, but the trend remains positive.

General indicators show an increase in loading rates from the Asia Pacific region and an increase in the share of requests for long-term contracts, a sign of better medium-term visibility for shippers.

But the indicators also show that activity is not expected to return to its 2022 level by the end of the year.

Air freight currently costs 23 times more than the maritime option and the cost of fuel weighs heavily on companies.

SEA FREIGHT

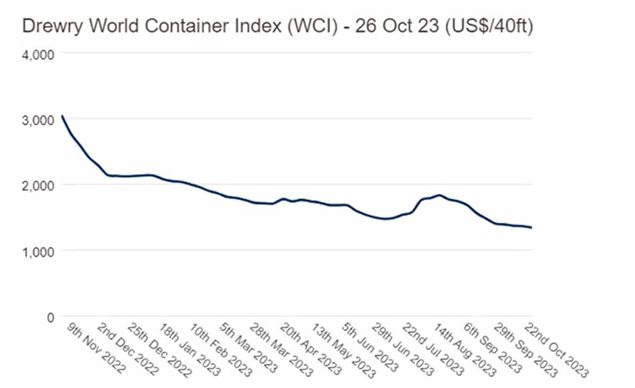

In a nutshell, the sea freight market is going through several adjustments at the same time: an increase in capacity, an increase in lead times, and stable demand : sea freight companies are trying to adapt their strategies in order to keep making profits.

By the end of October, 315 ships, or 4.3% of the total global fleet, were idle, compared to 271 two weeks earlier.

In total, 1.18 million TEU's of capacity were withdrawn from the market.

A figure to add to blank sailings or even to the slowing down of navigation speeds, the two primary capacity reduction levers: the rate of blank sailings on Asia-Europe was 25% in October.

As a consequence, companies are hoping that spot rates will regain strength in the coming weeks and seem determined to continue reducing capacity on the route in order to counterbalance a relatively stable demand.

Major carriers such as MSC and Maersk have announced that they will cancel several crossings over seven weeks until December: the winter of 2023-2024 should see an unprecedented number of container ships in hibernation.

This voluntarism is bearing fruit and has recently begun to be reflected in the increasing loading rate of ships.

Besides, ocean freight demand on most trade lanes is not meaningfully increasing in October and in parallel, additional capacity continues to be delivered into the global fleet.

From January 2023 to July 2023,deliveries of new vessels were the equivalent of 1.2 million TEU’s entering the global fleet, with less than 80,000 TEU’s capacity removed through vessel scrapping.

Another 1.2 million TEU’s are expected to be added by the end of the year. To put this into perspective, the previous single-year record for annual growth was about 1.7 million TEU’s back in 2015.

As a consequence, vessel capacity continues to trend higher than demand, keeping rates from long-lasting or significant increases.

As such, the steamship lines will continue voiding sailings and slow steaming.

This will allow them to allocate more vessel/capacity per service and save on bunker costs. They are also suspending some full services or cutting down some service size drastically.

Consequently, delays and cargo rollover on head haul routes, as well as empty equipment congestion at the backhaul route origins are becoming more common.

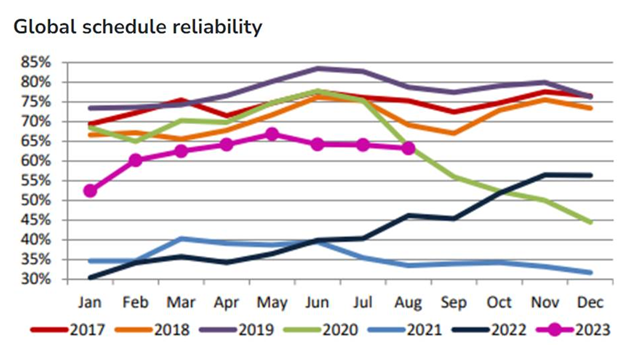

The consequences of Black sailings are a lack of stability in schedules and transit times and a challenge that will likely continue for months to come.